CSA Bi-Weekly Update (8.15.25)

- County Supervisors Association of Arizona

- Aug 15, 2025

- 9 min read

Updated: Sep 11, 2025

In the August 15th, 2025, edition of the CSA Weekly Update:

Thank you, Senator Kavanagh! Supervisor Miller Presents Majority Leader with Good Government Award

County Visits Continue: CSA in Greenlee, Graham, Cochise, and Navajo Counties!

ACMA Meets in Tubac: Managers Get First Look at County Submitted Proposals

CSA at Tax Conference: Special Taxing Districts Presentation

Federal Updates: Tax Conformity, SNAP, Medicaid and More

Upcoming Deadlines, Conferences, and Webinars: NACO Ongoing Webinar - Inside Washington: County Impacts from the White House & Congress

Lifelong Learning: Upcoming NACo Webinars

Thank you, Senator Kavanagh! Supervisor Miller Presents Majority Leader with Good Government Award

On August 14th, County Supervisors Association (CSA) Immediate-Past President (and

Pinal County Supervisor) Stephen Miller met with State Senator John Kavanagh (LD 3)

to present him with the CSA "Good Government Award." Senator Kavanagh, who was

recently named the Majority Leader of the Senate Republican Caucus, sponsored SB

1035: postconviction relief proceedings; hourly rates on behalf of the Association. The

Senator has consistently made time to speak to Association staff about legislation of

interest, and has acted as an advocate for local governments at the state's Capitol.

Senator Kavanagh joins Senator (and former Supervisor) Hildy Angius (LD 30),

Representative Selina Bliss (LD 1), and Senator Rosanna Gabaldón (LD 21) as

recipients of Association awards in 2025.

Thank you, Senator Kavanagh, for your dedication to good government!

County Visits Continue: CSA in Greenlee, Graham, Cochise, and Navajo Counties!

Over the past two weeks, the County Supervisors Association has continued our

outreach to counties across the state. It is a highlight of the interim to travel to the

counties and give an overview of the Association's efforts on behalf of the Boards of

Supervisors over the past fiscal year. The county outreach presentation includes

information on the Association's research initiatives, the impacts of recent legislation on

local governments, and how the Association works to advance the policy goals of the

counties at the state legislature.

Thank you to Graham, Greenlee, Cochise, and Navajo counties for your hospitality and

participation in CSA!

CMA Meets in Tubac: Managers Get First Look at County Submitted Proposals

On August 8th, the County Managers and Administrators met in Tubac to receive

updates on CSA research priorities and county-submitted policy proposals. The meeting

focused on the finalization of the Detention Officer Retention Study, how counties

interact with the Department of Emergency Management and Military affairs as well as

the Federal Emergency Management Agency in time of environmental disasters, and

upcoming timelines and submissions for the CSA Policy Summit in October.

Managers and administrators had insightful conversations about the outcomes of the

study and discussed best strategies on how to use the data collected by the

Association. The CSA Policy Summit and subsequent policy and research agendas are

contingent upon the support of a supermajority of county Supervisors, so

communication with county managers and administrators is a crucial part of the summit

preparation process. The Association is grateful for the insights managers are able to

provide and the collaborative nature of the CMA membership.

CSA at Tax Conference: Special Taxing Districts Presentation

This week, CSA staff had the opportunity to present at the Arizona Tax Conference in

Flagstaff. Our session focused on special taxing districts—covering the many types of

districts in Arizona, how they are formed and operate, and how they interact with state,

county, and other government offices.

The annual conference, co-hosted by the Arizona Department of Revenue and the

Arizona Association of Assessing Officers, brings together federal, state, county, and

local tax professionals from across Arizona to share knowledge and best practices. A

special thank you to AACo, the Arizona Department of Revenue, and the Arizona

Association of Assessing Officers for hosting.

Federal Updates: Tax Conformity, SNAP, Medicaid and More

Last month, Congress passed H.R. 1, also referred to as the “Big Beautiful Bill.” While there are currently no direct mandates on counties, several provisions in the legislation may have downstream impacts depending on how the state chooses to respond—particularly in areas related to tax conformity, SNAP, and Medicaid.

We’ve outlined a summary below of the key provisions that could have an impact on counties. Please note that this is a preliminary overview, and we’re still assessing the full scope of the legislation as more analysis from JLBC, NACo, and additional federal partners is made available. We’ll continue to provide updates to you as we hear more.

Tax Conformity

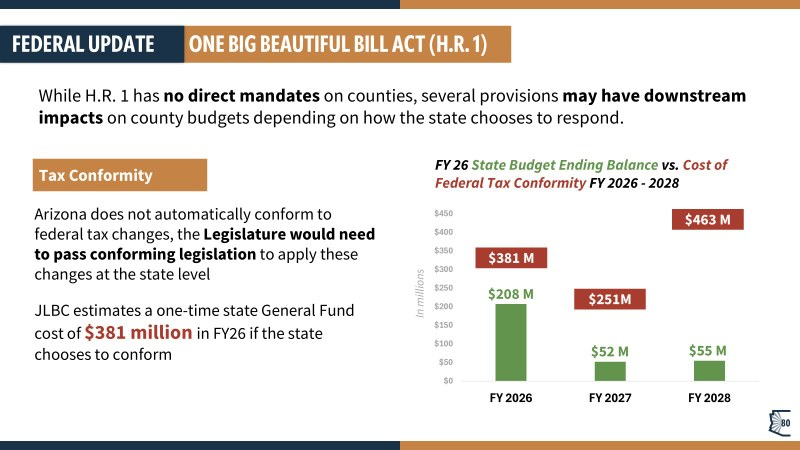

Most federal tax changes included in H.R. 1 will take effect for Tax Year 2025, impacting returns filed in spring 2026. Because Arizona does not automatically conform to federal tax changes, the Legislature would need to pass conforming legislation to apply these changes at the state level.

JLBC estimates a one-time State General Fund cost of $381 million in FY 2026 if the state chooses to conform. As a reminder, the recently enacted FY 2026 state budget anticipated an ending state general fund balance of $208 million in FY 2026

Supplemental Nutrition Assistance Program (SNAP)

SNAP is administered by the Arizona Department of Economic Security (DES). Prior to H.R. 1, the federal government covered 100% of SNAP benefit costs, while the state and federal governments shared administrative costs equally (50/50). Key changes under H.R. 1 include:

Cost Sharing for Benefits:

States with payment error rates above 6% will begin sharing up to 15% of benefit costs, scaled based on the state's payment error rate.

JLBC estimates: $139 million cost to the state in FY 2028, growing to $185 million annually beginning in FY 2029. This estimate assumes Arizona maintains it's FY 2024 payment error rate of 8.8%.

Administrative Cost Shift:

The state will see their share of administrative costs increase from 50% to 75% starting in FY 2027.

JLBC estimates: $33 million cost to the state in FY 2027, with ongoing annual costs of $44 million starting in FY 2028.

Expanded Work Requirements:

New work requirements for certain SNAP enrollees could result in increased administrative costs for DES. Fiscal estimates are not yet available.

Medicaid Provisions

Medicaid in Arizona is administered by AHCCCS and funded by a combination of federal, state, and local dollars. The following changes are expected to carry financial and administrative implications for the state:

Work Requirements & Eligibility Redeterminations:

Stricter work requirements for certain enrollees may increase administrative responsibilities and costs for AHCCCS.

New verification and redetermination requirements will add to the state’s administrative burden, with potential staffing and systems implications.

JLBC estimates that these two provisions are estimated to reduce enrollment by 171,000 members by 2030, most of which is associated with the increased work requirements.

Provider Tax Limitations:

The bill lowers the federal “safe harbor” threshold for provider taxes from 6% to 3.5% by 2032. Arizona currently assesses a 6% tax on providers to draw down additional federal dollars for Medicaid. Hospitals receive additional payments through this mix of provider taxes and matching federal funds. Over time, these payments will shrink—about $1.1 billion less than in FY 2032 compared to FY 2026, or $2.1 billion less than they would have without H.R. 1.

JLBC anticipates that the 3.5% tax will still generate enough revenues to cover the Medicaid expansion population and will not have an associated general fund impact.

Secure Rural Schools (SRS)

The final version of H.R. 1 did not include a reauthorization of the SRS program for FY 2024. However, the Secure Rural Schools Reauthorization Act (S. 356) passed the Senate by unanimous consent on June 18, and NACo remains optimistic about final passage.

In the meantime, counties received 25% timber payments in April 2025

If SRS is reauthorized retroactively, the county would receive an additional “hold harmless” payment to cover the difference between the timber payment and the full SRS amount.

If SRS is not reauthorized, this will impact PILT payments for FY 2026. Please see CSA's analysis of the interaction between SRS and PILT here.

Renewable Energy Revenue Sharing

Section 80182 of H.R. 1 creates a revenue-sharing model for wind and solar projects on federal lands, mirroring the existing oil and gas model.

25% of federal revenues will be allocated to the county where the project is located,

25% to the state, and

50% retained by the U.S. Treasury.

This includes bonus bids, rental payments, and other leasing-related revenues.

Rescissions Package

Congress also approved a $9 billion rescissions package, which primarily pulls back funds from:

The Corporation for Public Broadcasting

The U.S. Department of State

U.S. AID and international assistance programs

There are early reports of a possible second rescissions package, but no bill language or details have been released at this time.

Further clarification of the impacts of H.R 1 is expected as JLBC completes their fiscal analysis, and the state decides how to implement certain bill provisions. For more information on the impacts of H.R.1 and other federal changes, you may read NACo's analysis of the local costs here. Additionally, NACo is hosting a recurring web series titled Inside Washington, which provides up-to-date information on the happenings at the federal level and their impacts on counties. Please find the sign-up link and more information here.

As always, we're happy to answer any questions or concerns you may have.

Upcoming Deadlines, Conferences, and Webinars

NACO Ongoing Webinar - Inside Washington: County Impacts from the White House & Congress

Biweekly on Thursdays | May 15 - December 11, 2025, 3:30-4:30 P.M. ET

Building off NACo’s First 100 Days webinar series, we are starting a biweekly series to provide timely updates and analysis on key developments from the White House and Congress. Each session focuses on policies and actions that directly impact counties — from federal funding and regulatory changes to intergovernmental partnerships. Tune in every other week to stay informed on how these evolving federal dynamics may shape county priorities, responsibilities and operations.

To register, please click here.

Lifelong Learning: Upcoming NACo Webinars + Events

Leading Your County's Digital Transformation

Tuesday, August 26th 1:00 - 2:00 P.M. EST

The digital era is upon us, and it has many leaders challenged by the digital transformation in front of them. NACo CIO Rita Reynolds and Dr. Tim Rahschulte, the chief architects of NACo’s AI Leadership Academy training program, are hosting this webinar to share insights and ideas on how some leaders are harnessing the power of digital products, services and processes to do more with less. Rita and Tim will demystify the digital era by looking to the past and providing insights into the future – that is, in many ways, predictable. Join this webinar to explore the key elements of digital transformation and learn practical strategies to prepare for the digital future. To be sure, this digital future is not all about technology. The digital era is also about meeting customer expectations, employee accommodations and leveraging models to operate the business of government. We will explore together the importance of building a digital-ready organization and the need for skilling employees to meet new demands of new work.

This webinar is brought to you by NACo EDGE, establishing people, purchasing, and performance cost-saving solutions that can be applied to counties nationwide. EDGE is owned by NACo, advised by county leaders and 100% focused on solutions for U.S. Counties. Learn more about NACo EDGE here.

To register, click here.

Understanding the Homelessness Executive Order: Federal Shifts, County Impacts and Next Steps

Tuesday, August 26th 3:00 - 4:00 P.M. ET

On July 24, the White House issued a sweeping Executive Order directing federal agencies to prioritize civil commitment, public safety and treatment-based interventions in addressing homelessness.

Join NACo on Tuesday, August 26 at 3:00 p.m. ET for a timely webinar outlining major changes to federal funding, grant conditions, and policy priorities that directly affect county homelessness programs, behavioral health systems and enforcement strategies. County leaders will hear about new funding opportunities, potential restrictions on harm reduction programs, data-sharing requirements and how to prepare for forthcoming agency guidance.

To register, click here.

The Big Shift and Cash Management - 5 Takeaways

Wednesday, August 27th 1:00 - 2:00 P.M. EST

The financial landscape for counties is evolving quickly, with rising costs, shifting federal support and growing expectations becoming part of everyday reality. This is what many are calling “the Big Shift,” a period that is reshaping how counties plan, prioritize and manage resources. In this webinar, Mike Ablowich, a seasoned public finance leader and Vice President at three+one, will share what the Big Shift means for counties today and five actionable strategies to help leaders remain proactive, confident and effective during this time of change. From strengthening liquidity management to using data to guide impactful actions, you will gain practical tools and insights you can put to work right away to protect your county’s financial health and unlock new opportunities, no matter how the environment continues to evolve.

This webinar is brought to you by NACo EDGE, establishing people, purchasing, and performance cost-saving solutions that can be applied to counties nationwide. EDGE is owned by NACo, advised by county leaders and 100% focused on solutions for U.S. Counties. Learn more about NACo EDGE here.

To register, click here.

Inside Washington: County Impacts from the White House & Congress

Thursday, August 21st 3:30 - 4:30 P.M. ET

Join NACo’s Government Affairs team for week six of a biweekly series on key developments from the White House and Congress. Discussions will focus on policies and actions that directly impact counties — from federal funding and regulatory changes to intergovernmental partnerships. Tune in for an inside look at how these evolving federal dynamics may shape county priorities, responsibilities and operations.

To register, click here.

Comments